Kako dobro poslujejo skladi tveganega kapitala (venture capital)? Tu je analiza s strani Kauffman Foundation, ki vlaga v vec kot 100 skladov VC:

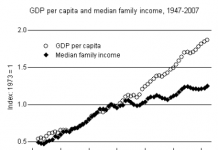

Venture capital (VC) has delivered poor returns for more than a decade. VC returns haven’t significantly outperformed the public market since the late 1990s, and, since 1997, less cash has been returned to investors than has been invested in VC. Speculation among industry insiders is that the VC model is broken, despite occasional high-profile successes like Groupon, Zynga, LinkedIn, and Facebook in recent years.

The Kauffman Foundation investment team analyzed our twenty-year history of venture investing experience in nearly 100 VC funds with some of the most notable and exclusive partnership “brands” and concluded that the Limited Partner (LP) investment model is broken1. Limited Partners—foundations, endowments, and state pension fund—invest too much capital in underperforming venture capital funds on frequently mis-aligned terms. Our research suggests that investors like us succumb time and again to narrative fallacies, a well-studied behavioral finance bias. …

….Only twenty of 100 venture funds generated returns that beat a public-market equivalent by more than 3 percent annually, and half of those began investing prior to 1995.

… The majority of funds—sixty-two out of 100—failed to exceed returns available from the public markets, after fees and carry were paid.

…There is not consistent evidence of a J-curve in venture investing since 1997; the typical Kauffman Foundation venture fund reported peak internal rates of return (IRRs) and investment multiples early in a fund’s life (while still in the typical sixty-month investment period), followed by serial fundraising in month twenty-seven.….The most significant misalignment occurs because LPs don’t pay VCs to do what they say they will—generate returns that exceed the public market. Instead, VCs typically are paid a 2 percent management fee on committed capital and a 20 percent profit-sharing structure (known as “2 and 20”). This pays VCs more for raising bigger funds, and in many cases allows them to lock in high levels of fee-based personal income even when the general partner fails to return investor capital.